What happens if the largest owner of oil and gas wells in the US goes bankrupt?

Diversified Energy’s liabilities exceed its assets, according to a new report, sparking concerns about whether taxpayers will wind up paying to plug its 70,000 wells.

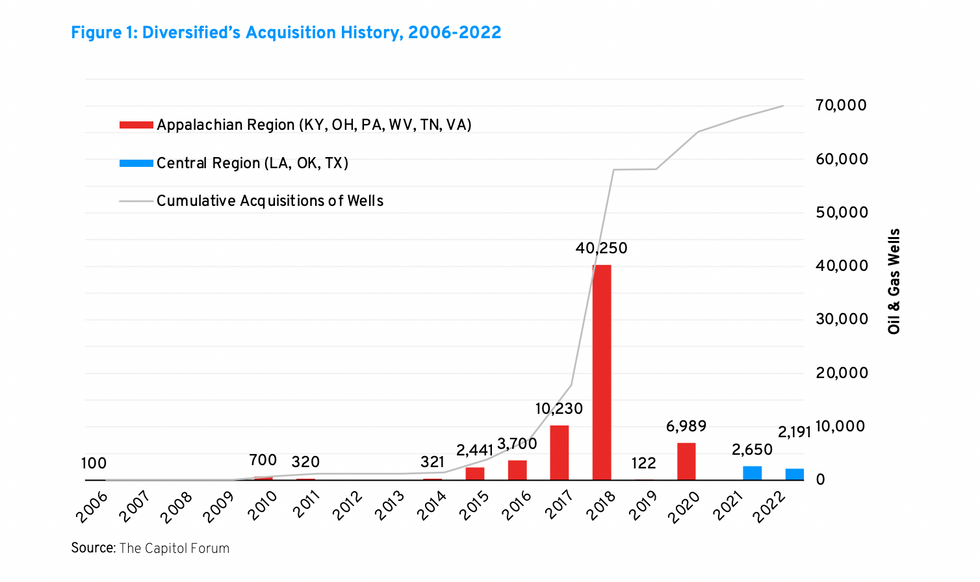

PITTSBURGH — Diversified Energy Company, the largest owner of oil and gas wells in the country, might abandon up to 70,000 oil and gas wells throughout Appalachia without plugging them, according to a new report.

The company, headquartered in Birmingham, Alabama, spent the last five years acquiring tens of thousands of aging, low-producing conventional oil and gas wells and some fracking wells primarily in Pennsylvania, Ohio, West Virginia and Kentucky. Conventional oil and gas wells are traditional wells where fossil fuels are extracted through vertical boreholes.

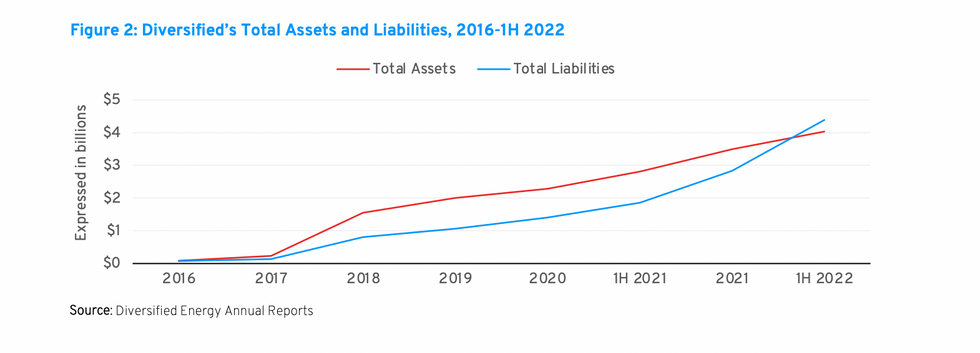

A new report, published by the Ohio River Valley Institute, a progressive think tank, finds that the company’s financial liabilities exceeded its assets by more than $300 million in June 2022. According to the report’s authors, it’s rare for an oil and gas company’s liabilities to exceed its assets to this extent, prompting concerns that Diversified Energy will go bankrupt without plugging its wells.

“We don’t want to see citizens and taxpayers have to pay for plugging these well after this company is gone,” Ted Boettner, author of the report and a senior researcher with the Ohio River Valley Institute, told EHN. “The way Diversified’s business model is set up, this is a distinct possibility.”

Boettner’s report expands on a previous report on Diversified Energy published by the same organization in April 2022 that found the company did not have enough funds on hand to plug its rapidly growing inventory of wells. That report also found that the company claims it can plug wells at a cost less than half the industry average, claims dying wells will continue producing for decades longer than can be reasonably anticipated, and misrepresents methane emissions.

“These unusual assumptions — as well as accounting practices that function to punt cleanup costs down the line — are not used by any other company in the industry,” Kathy Hipple, report coauthor and research fellow at the Ohio River Valley Institute, said in a statement at the time.

The new report finds that those practices have continued, with the company acquiring additional wells while lowering the amount it expects to pay to decommission them.

A spokesperson for Diversified Energy declined to comment on the specific financial concerns outlined in the report, but told EHN, “like other publicly traded peers, we’re held to strict financial reporting standards, including third-party auditing, and we’re measurably reducing emissions by deploying hand-held methane detectors, eliminating or replacing pneumatics, and upgrading equipment.”

They added that Diversified Energy retires wells responsibly and is “helping states tackle the orphan well challenge.”

The Ohio River Valley’s new report comes on the heels of a December report by the Pennsylvania Department of Environmental Protection finding that abandonment of wells and improper reporting by the conventional oil and gas industry are the norm, rather than the exception in Pennsylvania.

The agency found more than 17,000 violations at conventional well sites between 2017 and 2021, with more than 3,300 violations issued over operators’ attempts to abandon a well.

“Clearly,” the report stated, “there is significant noncompliance with relevant laws in the conventional oil and gas industry in Pennsylvania.”

Unplugged oil and gas wells can emit climate-warming methane and air pollutants that are hazardous to human health, contaminate soil and groundwater, and allow gas to migrate into occupied buildings, creating a risk of fatal explosions. When drillers abandon wells without plugging them, taxpayers are generally left to clean up the mess.

In 2021, reporters for Bloomberg visited 44 of Diversified Energy’s aging wells throughout Appalachia and found methane leaks and an observable lack of maintenance at most of them, with many wells appearing abandoned.

Corporate welfare

The 2021 federal Infrastructure Investment and Jobs Act allocated $4.7 billion to plug abandoned oil and gas wells throughout the country. Soon after the legislation was passed, Diversified Energy began acquiring well-plugging companies to take advantage of these federal funds.

Diversified Energy has not received federal funds to plug its own wells, but the new report from the Ohio River Valley Institute found that through one of its new well-plugging subsidiaries, the company secured federal funding to plug other orphan wells at a per-well cost more than six times greater than the company earmarks to plug its own wells.

“All of this leads me to believe that Diversified’s business model is built on a faulty foundation,” Boettner said. “This is something regulators should be taking a closer look at.”

Boettner also noted that many wells listed as abandoned by the Pennsylvania Department of Environmental Protection and submitted to the federal government for its orphan well plugging program actually have documented owners, including Diversified Energy, which by law should be liable for plugging them.

In May 2022, the Sierra Club informed the Pennsylvania Department of Environmental Protection that the federal list of orphaned wells that state regulators hope to use federal funds to plug includes 7,300 active wells in Pennsylvania that still have identified owners. The group urged state regulators to require the companies that have profited from these wells to pay for their cleanup instead of putting the burden on taxpayers.

The Pennsylvania Department of Environmental Protection said it doesn’t have the resources to track down the owners of these wells and require the companies to pay for plugging them and was considering hiring contractors to help.

The Sierra Club, along with a number of other environmental advocacy groups, also petitioned Pennsylvania state regulators to look into increasing bonding for the oil and gas industry to protect against abandoned wells in the future.

Pennsylvania’s current bond rate for conventional oil and gas wells is $2,500 per well or a blanket bond of $25,000 to cover all of a company’s wells.The petition, however, estimates that the full cost of plugging and reclaiming a conventional oil and gas well is $38,000 and a Marcellus Shale fracking well is $83,000, so it recommends raising bond rates to those levels.

Wells drilled before 1984 don’t require any bonds in Pennsylvania, so the actual funds on file to cover Pennsylvania’s conventional wells amounts to just $15 per well, according to the Pennsylvania Department of Environmental Protection. The agency is studying whether raising bonding rates to the levels recommended by the petition is feasible.

Unusual accounting practices

The new report highlights a number of unusual accounting practices used by Diversified Energy, which Boettner said are not typical for the oil and gas industry.

They include claiming it can plug wells for less than half the industry standard cost, assuming dying wells will continue producing for longer than they’re likely to in order to delay plugging them, understating the rate at which oil and gas production is likely to decline over time, recording acquisitions as financial gains, and carrying forward $183 million in unused tax credits, which it generated when gas prices were low.

“It’s honestly hard to make heads or tails of the way they report some of these financials,” Boettner said, “but we do know that much of what they’re doing is not typical.”

Every well is different and requires different costs to plug based on its age, depth and location. Some wells can be plugged for as little as $5,000, while some can cost as much as $125,000 to plug, Boettner said, noting that Diversified Energy could streamline some of its plugging costs now that it owns several well-plugging companies.

“But even given all of that, these numbers are still well below industry norms,” he added. “No matter how you look at it, they’ve just continued to make very questionable assumptions regarding retirement of their well inventory.”

Gas prices have soared in recent years, but Diversified Energy has missed out on most of that revenue because it engages in a practice known as “hedging” — locking in a price for oil and gas to hedge against volatile shifts in the market. This ensures that they’ll get that minimum price even if the market price is lower, but also prevents them from reaping large profits when the market price is high.

“The bottom line is that it’s highly unlikely that this company will have enough revenue to be able to plug all of its wells,” Boettner said. “Their financial outlook is not good, and if something happens to this company, we’ll all be on the hook for it.”

Editor’s note: Both Environmental Health News and the Ohio River Valley Institute receive funding from the Heinz Endowments.