Appalachia’s fracking counties are shedding jobs and residents: Study

The 22 counties that produce 90% of Appalachian natural gas lost a combined 10,339 jobs between 2008 and 2021.

PITTSBURGH — The largest natural gas-producing counties in Appalachia have had worse economic outcomes than the rest of the region and the nation since the start of the region’s fracking boom, according to a new report.

In the early days of the Marcellus Shale boom, the natural gas industry and policymakers promised that the industry would bring economic prosperity, including hundreds of thousands of new jobs and downstream businesses to the region, which has long been plagued by a lack of jobs and dwindling populations. The Marcellus Shale spreads across New York, Pennsylvania, Ohio, West Virginia, Maryland, Tennessee, Virginia and Kentucky.

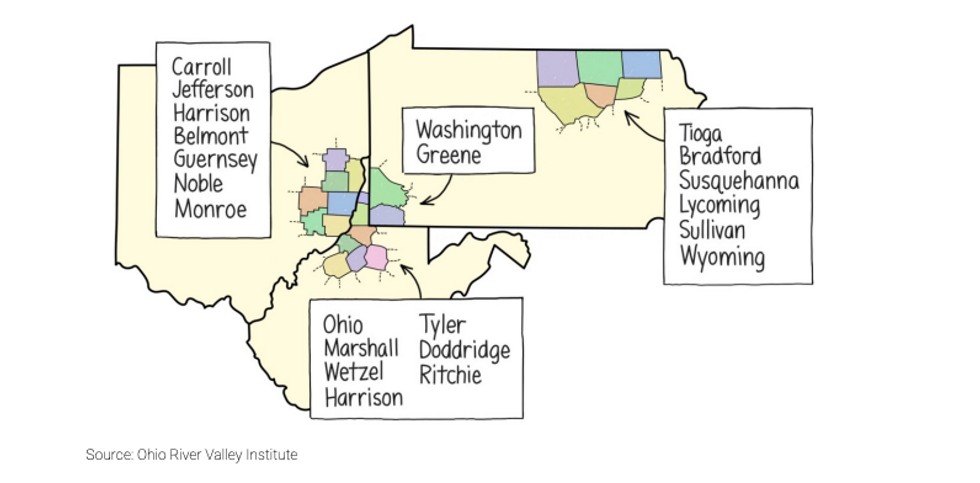

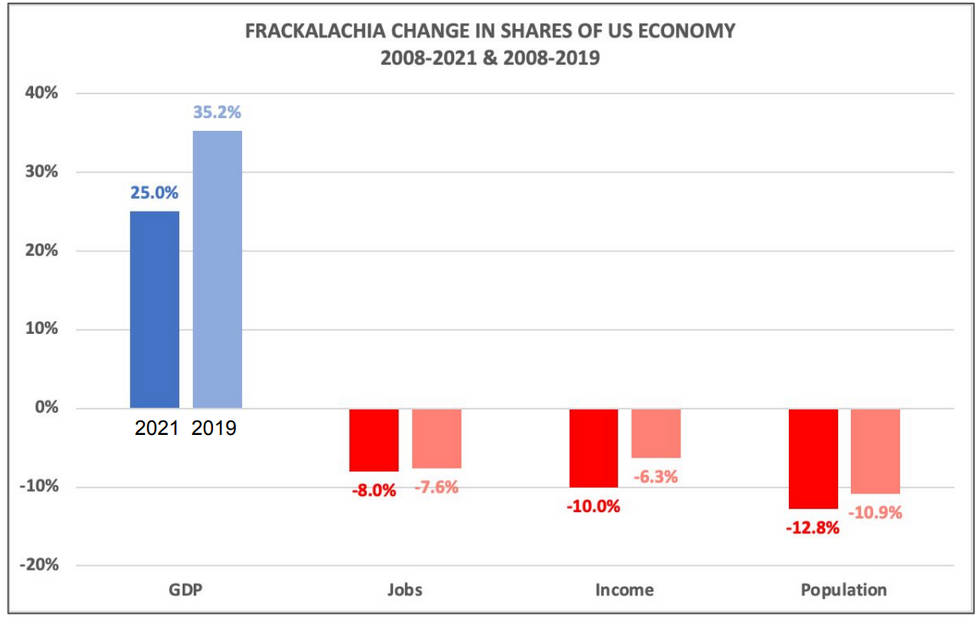

The report, conducted by the progressive think tank Ohio River Valley Institute, found that the 22 counties in Pennsylvania, Ohio and West Virginia that produce 90% of Appalachian natural gas actually lost a combined 10,339 jobs and 47,652 residents between 2008 and 2021. Income growth in these counties also trailed growth for the combined states of Ohio, Pennsylvania and West Virginia by 4 percentage points, and the U.S. as a whole by 16 percentage points, according to the report.

The Ohio River Valley Institute published a similar report in 2021 that looked at data from 2008 to 2019. The new report adds data from 2020 and 2021 to the analysis and finds that economic decline in these counties has generally continued despite a boost in natural gas prices and production in recent years.

“There are still many policymakers and people in the region who hold out hope that natural gas development and downstream industries like petrochemicals will ultimately become an economic savior,” Sean O’Leary, lead author of the report and a senior researcher at the Ohio River Valley Institute, said during a press conference. “That faith is being undermined.”

Petrochemical plants have been proposed throughout Appalachia to turn fracked gas into plastic (99% of plastic is made from fossil fuels). As the world decarbonizes, the oil and gas industry is increasingly turning toward plastic production to sustain demand for fossil fuels. To date, only one Appalachian petrochemical plant has been built — Shell’s ethane cracker in western Pennsylvania — and so far, it has also failed to deliver economic growth in surrounding communities.

Several Pennsylvania lawmakers who support the oil and gas industry in the name of local economic development did not immediately respond to requests for comment on the report. The industry makes sizable donations to oil and gas-friendly lawmakers in the state.

More oil and gas, fewer jobs

Credit: Ohio River Valley Institute

In addition to analyzing job and income growth, the report uses Pittsburgh-based EQT Corporation, the largest domestic producer of natural gas in the U.S., as an example of why the industry hasn’t resulted in more economic growth.

In 2010, EQT Corporation ranked 25th among U.S. natural gas producers and employed 1,815 people. By 2021, its output had more than tenfolded and it had become the number one producer in the nation, but it had just 624 employees. Some employees were lost to a spin-off, but including the employees at the spinoff company (Equitrans Midstream) brings the company’s total job count to just 1,395 in 2020 — still a quarter smaller than EQT’s workforce in 2010.

“EQT’s tale of skyrocketing output accompanied by a workforce decline of about a quarter sheds light on the economic potential of the shale gas industry,” O’Leary said in a statement. “It also shows why, as the gas industry matures, it becomes less jobs-intensive and less economically stimulating: as existing wells account for a growing share of output, fewer workers are needed to dig new wells or construct new transport infrastructure.”

In recent years, policymakers in Appalachia have pinned their hopes for economic development from fossil fuel extraction on downstream businesses like petrochemicals and a proposed hydrogen hub, which O’Leary says face similar challenges when it comes to fostering local economic development.

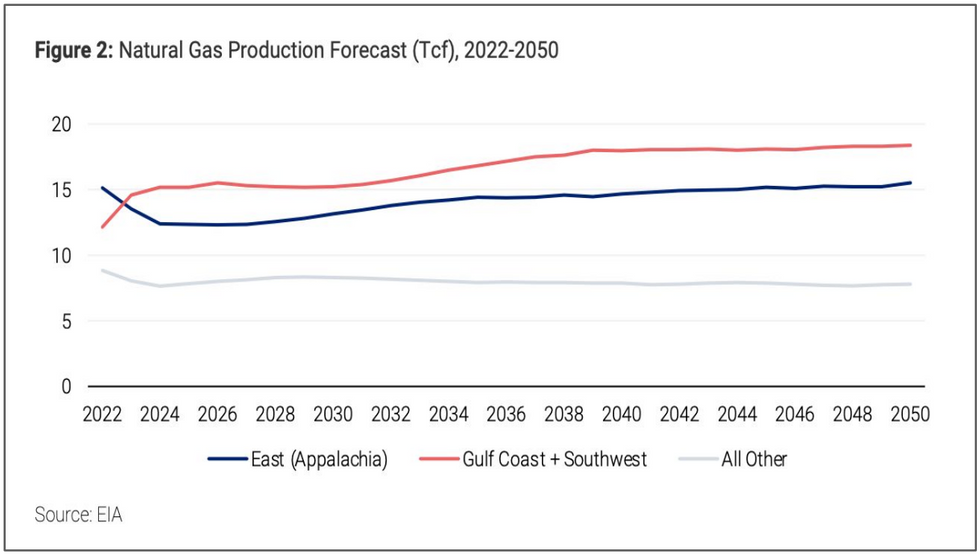

The Energy Information Administration’s most recent forecast for domestic natural gas production between now and 2050 estimates that natural gas production will stagnate, which could drive employment rates for the industry even lower.

“This industry was not able to deliver prosperity during the time when it was vibrant and growing,” O’Leary said, “so what are the chances that it's likely to do that as it reaches the stasis of middle age and stagnates?”

Alternative paths to economic growth

A coal town called Centralia in Washington state took an innovative approach to economic redevelopment after the shut-down of its two largest employers, a coal mine and a coal-fired power plant.

Centralia and surrounding Lewis County used $55 million in federal economic transition funds toward initiatives focused on energy efficiency, renewable resources and education to create local jobs. Within four years of receiving that funding in 2016, Centralia recorded job growth at twice the national average, wage growth 50% greater than that of the nation, a restored downtown and a growing population.

In 2021, the Ohio River Valley Institute authored a report detailing Centralia’s strategy and illustrating how economically distressed fossil fuel communities in Appalachia could follow suit.

“That’s critical for a region which has seemingly tried everything else,” O’Leary said. “And pursuing the Centralia model doesn’t conflict with the hydrogen hub, or a petrochemical hub, or even natural gas. It just means that we should stop mistaking the natural gas industry and its assorted hubs for economic development strategies, because they are not.”

Editor's note: The Ohio River Valley Institute and EHN.org both receive funding from the Heinz Endowments. Their work remains independent from the foundation.